Build your Singapore team

With white-glove localized support. Starting at just $199/month.

Get compliant employment contracts, local payroll, and expert-backed onboarding, all in one place with our Employer of Record in Singapore.

- Hire & pay without setting up a local entity

- Handle full-time employees and contractors

- Onboard in 3–5 business days

Schedule a demo

Trusted by global leaders across industries

Our clients include SaaS, logistics, e-commerce companies across sectors that are looking to grow their business globally. Become one of them.

Tap into Singapore’s skilled talent without breaking the bank

Skilled, English-speaking professionals

Tech, finance, support, you’ll find talent across every function

Business-friendly hiring environment

Singapore comes with low employment overheads & employer-friendly regulations

Ready to work

A remote-ready workforce with global experience means less training, more output

Exploring entity setup in Singapore for hiring? Think again

It’s costly, time-intensive, and loaded with paperwork

Why deal with compliance alone?

We can help you take care of employment contracts, payroll as per local laws, and more.

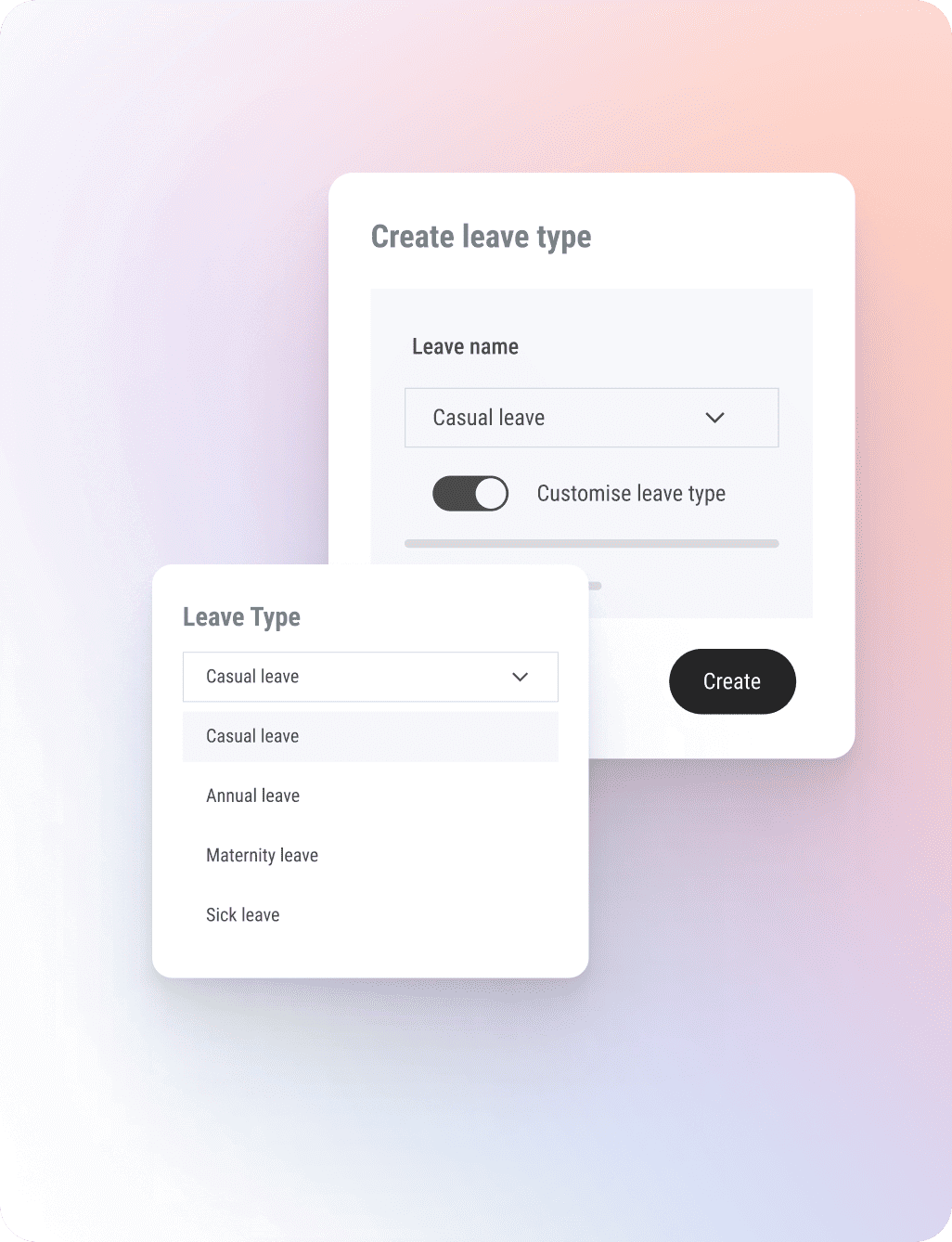

Payroll would mean more than just payouts

It includes monthly SCPF deductions, IR8A submissions, salary structuring, and local leave entitlements, and we handle it all.

No need to set up a legal entity

With us, you can onboard employees or contractors legally with minimal delays and risk, and help get your global team off the ground effortlessly and at speed.

PRICING

Transparent. Trusted. Scalable.

Employer of Record

(EOR)

Hire, pay and manage employees

Starts at

$199

per employee/month

Features

- Local employment agreements

- Personalised onboarding support

- Process payroll in 70+ currencies

- Labor law and tax compliance

- Benefits administration options

- Dedicated account managers

- Help center access

- Unified dashboard + third-party integrations

Agent of Record

(AOR)

Engage, pay and manage contractors

Starts at

$99

per contractor/month

Features

- Support with contracts

- Streamlined contractor onboarding

- Compliant contractor payments in 70+ currencies

- Support mitigating misclassification risks

- Dedicated account managers

- Help center access

- Unified dashboard + third-party integrations

Contractor Management System (CMS)

Handle contractor payments

Starts at

$19

per contractor/month

Features

- Contractor payments in 70+ currencies

- Invoice creation and tracking

- Expense submission and approvals

- Downloadable payment history

- Unified dashboard + integrations

- Mobile app access & localised support

Why do companies choose Payoneer Workforce Management to hire in Singapore?

Transparent, Flat Pricing

Starting at $199 for EOR with 100% transparency in the fee structure. Consistent cost regardless of seniority, role type, or team size

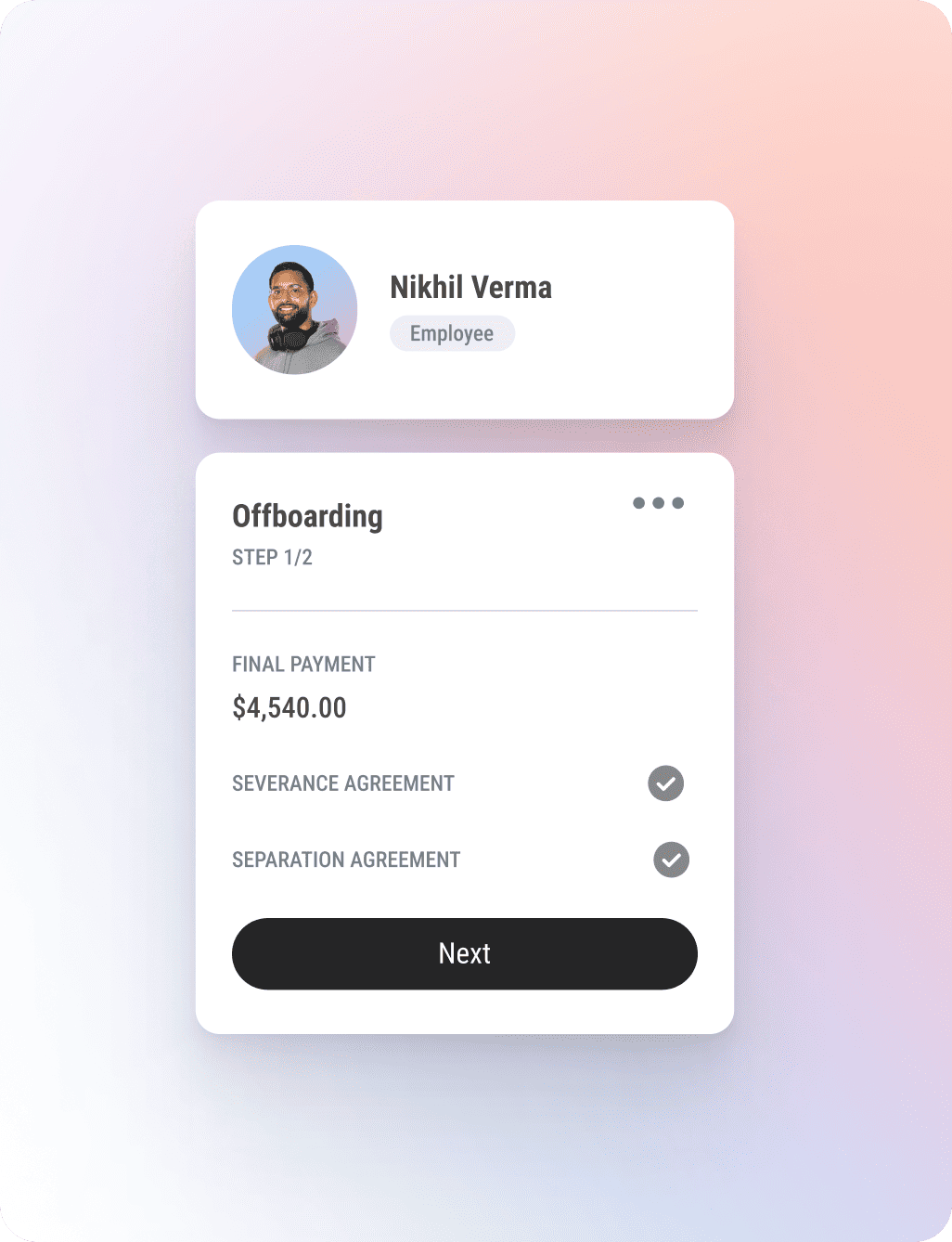

White-Glove Onboarding

Dedicated account manager for both you & the employees. Enjoy localized support across time zones

Additional Local Support

Background checks, device provisioning, and co-working access

Deep Integrations

Integrate with 70+ tools across HRIS, accounting, and time-tracking. No process disruption. Just smooth operations

Mobile App

Stay in control wherever you are. The Payoneer Workforce Management app supports both employers and contractors

User-Friendly Interface

With an interface that’s clean and ready to go, Payoneer Workforce Management is designed for busy teams that dislike a steep learning curve

The all-in-one platform for global hiring

160+

Countries covered

70

Currencies for payroll

24×5

Dedicated Support

100%

Transparency in fees

Frequently asked questions (FAQs)

Payoneer Workforce Management helps businesses hire in Singapore without setting up a local entity. We can help you handle employment contracts, payroll, CPF contributions, and compliance with Singapore’s labor laws, while you manage the day-to-day work.

Our EOR pricing starts at $199/month per employee. Contractor management starts at $19/month. Pricing includes onboarding, payroll processing, CPF filings, and localized support.

No. Payoneer Workforce Management acts as the legal employer, allowing you to hire and pay employees in Singapore without incorporating a company locally.

We can help manage statutory entitlements, like CPF contributions, paid time off, and work injury coverage. Additional benefits like equipment provisioning or private insurance can be considered based on your needs.

Yes. Employer of Record (EOR) is a legally recognized model in Singapore. The EOR becomes the official employer on paper, handling compliance, payroll, and employment contracts while you direct day-to-day work.

Onboarding usually takes 3–5 business days, assuming documents and approvals are completed on time.

Written employment contracts are mandatory, consisting of key employment terms (KETs). They must outline job responsibilities, salary structure, benefits, leave entitlements, and termination clauses in compliance with Singapore’s Employment Act.

The information on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer Workforce Management representative or account executive. Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries shall provide EoR, AoR, and contractor management services.